In this text, I’ll cowl two necessary benefits that the Forex market affords to traders.

Daytrading with a small account

If you wish to day trade with shares and you’ve got lower than $25.000 on the account, you’re prone to have a tough life. The cause is {that a} rule referred to as “pattern day traders” permits you to day trade freely solely you probably have that quantity or extra in your account. If you will have much less, your day trades (positions entered and exited the identical day) are restricted to a few in any 5 trading days interval. Your dealer ought to monitor your exercise and be sure to don’t execute trades that aren’t allowed beneath the “pattern day traders” rule. This regulation applies to shares and inventory choices. The Forex market at the time of this writing will not be concerned.

Risk Control

The Forex market has two traits that will translate into greater risk control in your trades. What I imply by risk control, is the likelihood to outline your most loss ought to the market transfer against you. If we don’t take into account using choices or different instruments as a hedge, the way in which to take control of losses is by utilizing a stop-loss order.

Nothing new, as much as right here. The downside that at instances traders face is {that a} cease order may be executed at a price a lot worse than the one meant and initially set.

Generally, there are two states of affairs in the place this could occur.

The first has to do with the liquidity of the market. Within this text, we are able to take into account liquidity as synonymous of trading quantity. it tends to “jump” from one stage to the following. This can have an effect on the execution of your orders in a damaging approach. The phenomenon can also be known as “slippage”. Here we take into account specifically the exit order, however, slippage can have an effect on your entry order as nicely, and this might translate in for instance in a purchase order executed at the next price than the one you wished to purchase. The Forex market doesn’t worry rivals about liquidity. 1.5 Trillions of greenbacks are traded in Forex every single day. The different markets observe at a giant distance.

The second issue that provides hassle to risk control is the occurrence of price gaps. Say your inventory closes at the moment at 63, and your cease order is at 61.5. In concept, your most risk is 1.5 factors per share. But the inventory for any cause tomorrow opens for trading at 57, and you can be stopped out at that price, so the precise loss will likely be 5 factors per share. Gaps are frequent in shares each time necessary news is introduced when the market is closed. Sometimes necessary news may cause a niche even intraday, particularly in a not-so-liquid market. In some different instances, the trading in an inventory is suspended simply within the wait of necessary pending news. A niche is virtually assured when the news is launched. Of course, your place also can profit from a niche, if the whole path is in your favor. But the purpose right here is that the occurrence of gaps reduces your energy to control risk with a stop-loss order. The Forex market is near all the time open from Monday to Friday. There may be wild intraday strikes attributable to news, however, the occurrence of gaps could be very uncommon inside the week.

These are simply two of the potential benefits the Forex market affords to traders. There are many others that I cannot cowl right here, from the price of trading (commissions are sometimes zero), to the quantity essential to open an account (which may be very low). All these issue clarify why the Forex market is attracting increasingly more traders.

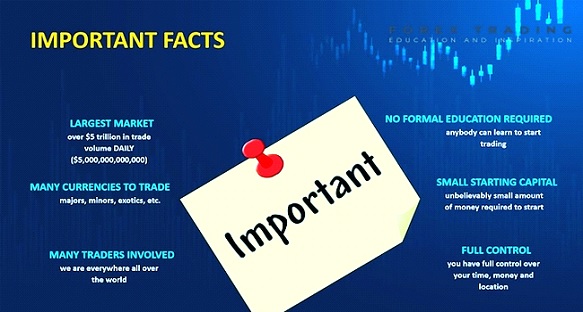

Forex and its Important Factors