Fibonacci forex trading is the premise of many forex trading techniques utilized by a large number of skilled forex brokers across the globe, and many billions of {dollars} are worthwhile traded yearly based mostly on these trading strategies.

Fibonacci was an Italian mathematician and he’s greatest remembered by his world well-known Fibonacci sequence, the definition of this sequence is that its fashioned by a collection of numbers the place every quantity is the sum of the 2 previous numbers; 1, 1, 2, 3, 5, 8, 13 …However within the case of forex trading what’s extra essential for the forex dealer is the Fibonacci ratios derived from this sequence of numbers, i.e. .236, .50, .382, .618, and many others.

These ratios are mathematical proportions prevalent in many locations and constructions in nature, in addition to in many synthetic creations.

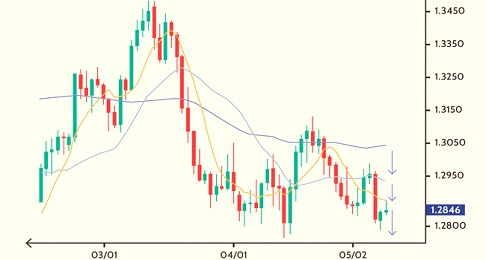

Foreign exchange trading can significantly profit from this mathematical proportions attributable to the truth that the oscillations noticed in forex charts, the place costs are visibly altering in an oscillatory sample, observe Fibonacci ratios very intently as indicators of resistance and assist ranges; possibly to not the final cent, however so shut as to be actually superb.

Fibonacci value factors, or ranges, for any forex forex pair might be calculated prematurely in order that the dealer will know when to enter or exit the market if the prediction given by the Fibonacci forex day trading system he makes use of fulfills its predictions.

Many individuals tries to make this evaluation overly difficult scaring away many new forex merchants which can be simply starting to know how the forex market works and easy methods to make a revenue in it. However this isn’t the way it must be. I cant say its a easy idea however it’s fairly comprehensible for any dealer as soon as she or he has grasped the fundamentals and has had some observe trading utilizing Fibonacci ranges together with different secondary indicators that may assist to enhance the accuracy of the entry and exit level for each explicit commerce.

Foreign exchange trading makes use of forex and inventory markets from a wide range of international locations to create a trading market the place hundreds of thousands and hundreds of thousands are traded and exchanged every day. This market is much like the inventory market, as individuals purchase and promote, however the market and the over all outcomes are a lot a lot bigger. These involved within the forex trading markets embody the Deutsche bank, UBS, Citigroup, and others resembling HSBC, Braclays, Merrill Lynch, JP Morgan Chase, and nonetheless others resembling Goldman Sachs, ABN Amro, Morgan Stanley, and so forth.

To get involved within the forex trading markets, contacting any of those massive dealer help corporations goes to be in your greatest curiosity. Certain, anybody can get involved within the forex market, nevertheless it does take time to find out about what’s sizzling, what will not be, and simply the place you must place your cash right now.

Worldwide banks are the markets greatest customers on the forex markets, as they’ve hundreds of thousands of {dollars} to take a position every day, to earn curiosity and this is only one methodology of how banks earn a living on the cash you save of their bank. Take into consideration the bank that you just take care of on a regular basis. Have you learnt for those who can go there, and procure cash from ‘one other’ nation in case you are heading out on trip? If it’s important to know in case your bank is involved in forex trading, you possibly can ask any supervisor or you possibly can take a look at the monetary info sheets that banks are to report back to the general public on a quarterly baiss.

If you’re new to the forex market, you will need to understand there is no such thing as a one particular person or one bank that controls all of the trades that happen within the forex markets. Varied currencies are traded, and can originate from anyplace on the earth. The currencies which can be most frequently traded within the forex markets embody these of the US greenback, the Eurozone euro, the Japanese yen, the British pound sterling and the Swiss franc in addition to the Australian greenback. These are just some of the currencies which can be traded on the forex markets, with many different counties currencies to be included as effectively. The principle trading facilities for the forex trading markets are positioned in Tokyo, New York and in London however with different smaller trading facilities positioned thought out the world as effectively