Until the popularization of web trading a few years in the past, FX was primarily the area of enormous monetary establishments, multinational companies, and secretive hedge funds. But occasions have modified, and particular person investors are hungry for data on this fascinating market.

What makes the relative value of Currency fluctuate? The first is due to a ‘real’ market: as exterior investors or guests want to purchase issues inside a country, they’re pressured to transform their home currency into the currency of the country they’re shopping for inside.

The second power for currency fluctuation is theory. During the East Asia Crisis in 1997, for instance, as nations in Asia started going through economic downturns, speculators used currency trading to appreciate huge earnings and in lots of analysts’ views helped to exacerbate the issue.

Benefits of Currency Trading

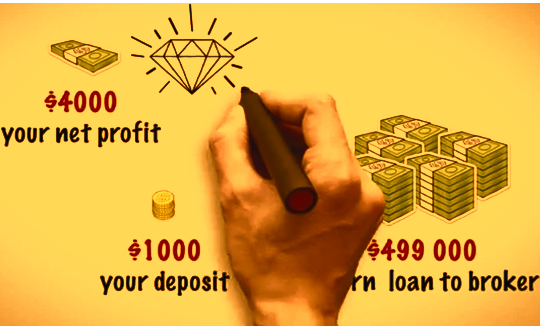

Currency trading has many very actual advantages over fairness trading just like the inventory alternate. The spreads for currency trading are extraordinarily low, making the price to a dealer very low as nicely. The volatility of the currency market is extraordinarily excessive, which implies that a dealer can generate an unlimited return on a given alternate. The ratio of volatility to unfold is roughly 500:1 for the currency trading market, as in comparison with 100:1 for even probably the most excellent of shares.

Until just lately, the currency trading market was very near small investors. Banking conglomerates and huge multinationals had been the primary movers of this market. In the previous few years, nevertheless, new applied sciences have opened the doorways to investors of all stripes. It is troublesome to overlook the big advantage of this ‘new’ market for the personal investor: increased returns with decreased danger given the identical quantity of market information have a really small drawback.

FacebookTwitterShare

It might come as a shock to the funding rookie, however, Forex is the largest market on the earth. These phrases check with the financial value of 1 country’s cash value (as measured by the country’s largest single-value denomination) and are often measured compared to the unit of currency utilized by the country during which the investor is a citizen.

The measure by which Forex is taken into account the largest market is by way of money value traded, and it’s utilized by each sort of funding conceivable, from people Forex is extraordinarily in style resulting from its excessive liquidity and its time capability (with three giant inventory markets open day lengthy in the course of the week, it’s doable to alternate international currency at each hour of the day). Liquidity is a time period that’s quick for market liquidity, which refers back to the capacity to shortly purchase or sell without inflicting a dramatic fluctuation in worth. As currency for international locations is set largely by inside (home) components somewhat than exterior ones, Forex is just not topic to the fluxes brought on by a panicked sell-off.

As the economic marketplace and arguably the defining middle of the world, the greenback of the United States is utilized by far probably the most in Forex transactions. Involved in 89% of transactions, the US greenback was the means forward of different currencies, adopted distantly by the euro (37%) after which the yen (20%). Remember that the numbers right here don’t add as much as 100% as a result of each transaction will comprise not less than two completely different currencies.

Forex speculators are a controversial subject amongst economists and politicians alike. One college of thought posits that the currency hypothesis can contribute to a country’s economic downfall, as a decrease in currency value causes the value of inflation compared to imported items to rise, snowballing the issue. The opposing view to the speculators as devices of economic downfall is that speculators serve to maintain currency regulated in response to worldwide agreements and that their earnings are the outcomes of fundamental economic legal guidelines. Those who subscribe to this concept usually level out that the opposing view is held all too usually by leaders looking to deflect consideration away from their very own home insurance policies when explaining to a populace why their financial system is in the bathroom.

Individuals wishing to develop into concern within the Forex market have to keep in mind that they need to accomplish that by a dealer or financial institution, our bodies regulated by their governments, and worldwide agreements to forestall the illegal revenue leading to economic injury to a special country.

What Is Forex? How To Get Rich!